How to Start Freelancing in Retirement (Step-by-Step Guide for Beginners)

Introduction

Retirement is often seen as a time to relax, travel, and enjoy life. But for many, the idea of earning extra income, staying mentally active, and maintaining a sense of purpose is just as important. If you’ve ever considered freelancing in retirement, you’re not alone. Many retirees are turning to freelancing as a way to work on their own terms while using the skills they’ve developed over a lifetime. Here are some tips on how to start freelancing during retirement.

Freelancing allows you to control your schedule, choose projects you enjoy, and work from home or anywhere in the world. Unlike traditional employment, there’s no boss, no rigid hours, and no mandatory commitments. Instead, you decide how much or how little you want to work. To become a freelancer, it’s essential to prepare by building a client base and developing a portfolio to showcase your skills.

For retirees, freelancing is an opportunity to turn expertise into income while maintaining a flexible lifestyle. Whether you have experience in writing, consulting, customer service, or design, there’s likely a demand for your skills. And even if you don’t have specialized experience, there are entry-level freelancing opportunities available. Balancing freelancing with a day job can be challenging, requiring effective time management to navigate both worlds successfully.

This guide will walk you through everything you need to know about starting a freelance career in retirement, from choosing the right niche and finding clients to setting your rates and growing your business.

Why Retirees Should Start Freelancing and Build a Flexible Income

Work on Your Own Terms

One of the biggest advantages of freelancing is flexibility. Freelancing allows retirees to work beyond normal working hours if they choose. You choose your own hours, decide which projects to accept, and work at a pace that suits your lifestyle. Whether you want to work a few hours a week or take on larger projects, freelancing gives you that freedom.

Many retirees appreciate this because it allows them to stay productive without the stress of a full-time job. If you want to take a vacation or spend more time with family, you can simply pause your freelance work and resume when you’re ready.

Put Your Skills to Good Use

Over the years, you’ve gained valuable skills and experience in your career. Freelancing allows you to monetize those skills while continuing to do work you enjoy.

For example, if you worked in business management, you could offer consulting services to small businesses. If you were a teacher, you might transition into online tutoring or educational content writing. Freelancing is about leveraging what you already know and turning it into a profitable income stream.

Earn Extra Income

Freelancing is a great way to supplement retirement income. Whether you’re looking to cover extra expenses, save for vacations, or simply enjoy financial security, freelancing can provide an additional revenue stream. However, it might take time to land a freelance gig immediately and build a steady stream of clients.

Unlike traditional jobs that require a long-term commitment, freelancing lets you start small and scale up based on your needs. Many retirees find that even a few hours a week can bring in a significant amount of money.

Defining Your Freelance Business

Defining your freelance business is a crucial step in establishing a successful and sustainable career as a freelancer. It involves identifying your niche and target market, setting clear business goals, determining your unique value proposition, and finding potential clients. Let’s break down each of these steps to help you get started.

Identify Your Niche and Target Market

Identifying your niche and target market is essential in defining your freelance business. Your niche is the specific area of expertise you specialize in, while your target market is the group of people or businesses you want to work with. To identify your niche and target market, consider the following questions:

What are your skills and strengths?

What industries or sectors do you have experience in?

What type of projects do you enjoy working on?

Who are your ideal clients?

What are their pain points and needs?

For example, if you’re a freelance writer, your niche might be writing for the healthcare industry, and your target market could be hospitals and medical device companies. By focusing on a specific niche, you can position yourself as an expert and attract clients who need your specialized skills.

Define Your Business Goals and Objectives

Defining your business goals and objectives is critical in establishing a successful freelance business. Your goals and objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider the following:

What do you want to achieve with your freelance business?

How much money do you want to earn?

How many clients do you want to work with?

What type of projects do you want to work on?

How do you want to grow your business?

For example, your goal might be to earn $50,000 per year, work with at least five clients, and complete at least ten projects per month. Setting clear goals will help you stay focused and motivated as you build your freelance career.

Determine Your Unique Value Proposition

Your unique value proposition (UVP) is what distinguishes you from other freelancers and makes you appealing to potential clients. It’s the unique benefit that you offer to clients that they can’t find elsewhere. To determine your UVP, consider the following:

What makes you unique?

What skills or expertise do you bring to the table?

What results can you deliver to clients?

How do you differ from other freelancers?

For example, your UVP might be that you’re a freelance writer with expertise in the healthcare industry, and you can deliver high-quality content that resonates with healthcare professionals. Clearly communicating your UVP will help you stand out and attract the right clients.

Choosing the Right Freelance Niche

Assess Your Skills and Interests

Before you start freelancing, it’s important to identify your strengths and interests. The best freelance niche for you will be one that aligns with your past experience, skills, and passions. Defining a niche and creating an online presence are crucial steps to becoming a successful freelancer.

Think about your previous jobs, hobbies, and personal interests. What tasks did you enjoy the most? What skills do you feel most confident in? Even if you worked in an industry that doesn’t seem “freelance-friendly,” chances are, there’s a related niche you can explore.

Popular Freelance Jobs for Retirees

Some of the most popular freelancing jobs for retirees include:

Freelance Writing & Editing – Content writing, copywriting, proofreading

Virtual Assistance – Email management, customer support, scheduling

Consulting & Coaching – Business strategy, career advice, financial consulting

Graphic Design – Logo creation, social media graphics, branding

Online Tutoring – Teaching English, math, or specialized subjects

Bookkeeping & Accounting – Managing finances for small businesses

Voice Acting – Recording narrations, audiobooks, and commercial ads

Social Media Management – Managing social media accounts and creating content

If you’re unsure where to start, choose a niche that matches your strengths and experiment with small projects to see what you enjoy most.

How to Find Freelance Work in Retirement: Best Platforms

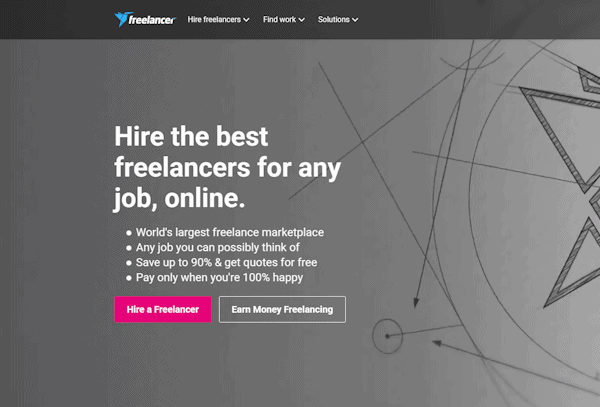

Best Websites to Get Started

There are dozens of freelance platforms where you can find work, but some are better suited for beginners and retirees. Here are some of the best websites to find freelance gigs:

- Upwork – Great for various freelance jobs, including writing, design, and consulting.

Fiverr – Best for selling specific services like logo design or resume writing.

Freelancer – Offers a wide range of job categories for all skill levels.

FlexJobs – Focuses on remote and freelance jobs, often ideal for retirees.

PeoplePerHour – Best for creative professionals like writers and designers.

LinkedIn – Excellent for networking and finding professional freelance opportunities.

Each of these platforms has different requirements and payment structures, so it’s worth exploring multiple options to see which one fits your needs best.

Finding Potential Clients

Finding potential clients is a crucial step in growing your freelance business. There are several ways to find potential clients, including:

Researching Companies: Look for businesses that need your services and reach out to them directly.

Networking: Connect with other professionals in your industry through events, online forums, and social media.

Freelance Platforms: Use platforms like Upwork, Fiverr, and Freelancer to find freelance projects.

Social Media: Leverage social media to showcase your work, share your expertise, and connect with prospective clients.

By actively seeking out potential clients and leveraging various channels, you can build a steady stream of freelance work and grow your business.

Setting Your Freelance Rates

Freelance Pricing Models

Pricing yourself correctly is key to getting clients and getting paid fairly for your work. There are two main pricing models:

Hourly Rates – Best for long term projects or ongoing work.

Project Based Pricing – Best for one off tasks like designing a website or writing an article.

Many freelancers start with lower rates to gain experience and build a portfolio, then increase their rates as they build credibility. Freelancers also have to pay self employment taxes every quarter.

Don’t Undervalue Your Work

New freelancers often make the mistake of charging too little. It’s tempting to take cheap gigs to get clients, but undervaluing your work will lead to burnout. Research industry rates and charge what you’re worth. Also remember to factor in self employment taxes when pricing yourself, as you’ll be paying those quarterly.

Marketing Yourself as a Freelancer

Build a Simple Website

Having a professional website makes you more credible and helps you stand out from other freelancers. Your website should include:

A bio showcasing your skills and experience

Portfolio samples of past work

A contact form for potential clients

Platforms like Wix, WordPress, and Squarespace make it easy to set up a professional website with minimal effort.

Use Social Media and Networking to Attract Prospective Clients

Social media is a powerful tool for freelancers. LinkedIn, Facebook groups, and Twitter can help you connect with clients, share your expertise, and showcase your work. Networking with former colleagues and industry professionals can also lead to new opportunities. Freelancing works best through strong client relationships and effective communication.

Managing Your Freelance Business

Staying Organized and Productive

Freelancing requires self-discipline. Use tools like Trello, Asana, or Google Calendar to track projects, deadlines, and client communications.

Handling Payments and Self Employment Taxes

Most freelance platforms offer built-in payment systems, but if you’re working independently, consider using PayPal, Stripe, or Wise for secure transactions. Keep track of income, expenses, and taxes to stay compliant with financial regulations.

Final Thoughts

Freelancing in retirement is a flexible, rewarding way to stay active while earning extra income. Whether you’re looking for a side hustle or a full-time gig, the opportunities are endless. Take the first steps in starting freelancing despite having no prior experience.

Take small steps, experiment with different niches, and gradually build your business. The key to success is patience, persistence, and continuous learning. Dedication is crucial in becoming a freelancer. If you’re ready to start freelancing, begin by choosing your niche, creating an online presence, and applying for small jobs.

What skills do you plan to use for freelancing? Let me know in the comments!

FAQs About Starting Freelancing in Retirement

1. Do I need any special skills to start freelancing in retirement?

No, you don’t need specialized skills to start freelancing, but having some experience in a particular field will help. Many retirees leverage their previous work experience in areas like writing, consulting, bookkeeping, virtual assistance, or tutoring. However, even if you’re new to freelancing, there are beginner-friendly opportunities like data entry, customer service, and transcription that don’t require advanced skills.

2. How do I find my first freelance job as a retiree?

The best way to find your first freelance job is to start on freelance marketplaces like Upwork, Fiverr, Freelancer, and FlexJobs. Creating a strong profile that highlights your experience, skills, and past work is crucial. Additionally, networking with former colleagues, joining LinkedIn groups, and reaching out to small businesses in your community can help you land your first gig.

3. How much can I earn as a freelance retiree?

Your earning potential depends on your niche, experience, and how much time you dedicate to freelancing. Some retirees make a few hundred dollars a month as a side hustle, while others earn thousands per month by offering high-value services. For example, freelance writers typically earn $30 to $100 per article, consultants can charge $50 to $200 per hour, and virtual assistants often make $15 to $40 per hour.

4. What are the best freelance jobs for retirees with no experience?

If you have no prior freelancing experience, start with entry-level freelance jobs that require minimal technical skills. Some great options include virtual assistance, data entry, proofreading, transcription, customer service, and online tutoring. As you gain experience, you can transition into higher-paying freelance opportunities.

5. How do I avoid scams when looking for freelance jobs?

To avoid freelance job scams, only apply for jobs on reputable platforms like Upwork, Fiverr, Freelancer, and FlexJobs. Be cautious of clients who ask for free work, promise unrealistically high payments, or request personal financial information. Always use secure payment platforms like PayPal or Stripe and never accept jobs that require upfront payment to “unlock” work opportunities.

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to us at no cost to you if you decide to purchase. This site is not intended to provide financial advice. You can read our affiliate disclosure in our privacy policy.