Leveraging Experience in Retirement: Turning Wisdom into Opportunity

Introduction:

After working for years, retirees have a treasure trove of knowledge and skills. That experience doesn’t lose its value in retirement – in fact, leveraging your experience in retirement can open doors to new opportunities. In this article we’ll look at how retirees can use their professional experience to stay active, contribute to society and potentially earn extra income.

The Value of Experience in Retirement

You know, it’s funny how things change. Back in the day retirement was seen as this finish line where you’d hang up your work boots and spend your days lounging on a beach somewhere. But let’s be real – that image is about as outdated as my old flip phone.

Now more and more retirees are realizing that their decades of experience are like a fine wine – they just get better with age. Many are exploring different career paths and leveraging their experience in retirement through volunteering and academic counseling, guiding others while continuing their personal development. And trust me, the world is starting to catch on to this goldmine of knowledge walking around in comfortable shoes.

I remember talking to my neighbor, Bob, who retired after 40 years in engineering. He thought he’d be happy pottering around in his garden, but after a few months he was itching to use his brain again. Long story short, he ended up consulting part-time for a startup and you should’ve seen the sparkle in his eye when he talked about mentoring those young whippersnappers.

Having a Unique Perspective

It’s not just about being busy, though. Retirees bring a unique perspective to the table that you can’t get from a textbook or a crash course. They’ve seen trends come and go, navigated economic ups and downs and learned a thing or two about dealing with people. That kind of wisdom is priceless, especially in today’s fast paced world where everyone’s looking for a quick fix. Retirees can make a meaningful impact in various roles, particularly in educational settings and freelance careers, by sharing their knowledge and mentoring others.

But here’s the kicker – it’s not just the companies that benefit. Being professionally engaged can be a real game changer for retirees too. It keeps the mind sharp, gives a sense of purpose and let’s face it, a little extra cash never hurt nobody. Plus it’s a great way to stay connected and avoid that isolation that can sneak up on you faster than you can say “early bird special”.

How Retired Pros Can Share Their Expertise

Now I’m not saying everyone needs to jump back into the 9-to-5 grind. There are plenty of ways of leveraging your experience in retirement without sacrificing your hard earned freedom. Mentoring, consulting, writing or even starting a blog (hey, if my technologically challenged uncle can do it, anyone can) are all great options.

The key is finding something that lights your fire. Maybe you were a whiz with numbers and could help small businesses with their finances. Or perhaps you’ve got a knack for problem solving and could lend a hand to community projects. The possibilities are endless, really.

Times Are Changing for Retired Pros

And let’s not forget about the changing perceptions of retirement and work. Gone are the days when 65 meant you were sent to the glue factory. Nowadays age is just a number and older people are leveraging their previous experience in retirement like a new currency. Companies are waking up to the fact that diversity isn’t just about race or gender – it’s about having a mix of perspectives and life experiences.

Yes, there might be a learning curve with some of the newfangled technology (I still remember the day I accidentally set my ringtone to a heavy metal song during a meeting), but that’s where the younger generation can lend a hand. It’s a two way street and that exchange of knowledge can lead to some pretty cool innovations.

So if you’re approaching retirement or already there, don’t think of it as the end of the road. Think of it as a new chapter where you get to write the rules. Leveraging your experience in retirement is valuable and there’s a whole world out there that could use what you know. Transitioning into a new career that aligns with your passions and skills can be incredibly fulfilling. Whether it’s leveraging your past experience to secure a role in a new field or starting something entirely different, the opportunities are vast.

Who knows? You might just do some of your best work yet. Just remember to take breaks for those early bird specials – some traditions are worth keeping, after all.

How to Apply Your Retirement Skills

Okay, let’s get down to business and put that hard earned wisdom to work. You’ve spent decades developing your skills and now it’s time to figure out how to share them without sacrificing your well deserved R&R.

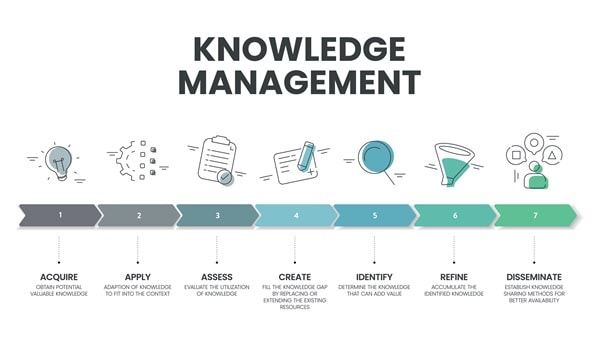

First things first, let’s talk about the smorgasbord of opportunities out there. It’s like a buffet of professional engagement and trust me, there’s something for everyone’s taste. By identifying and leveraging your relevant skills, you can unlock new opportunities and overcome age bias. Conducting a SWOT analysis can help you pinpoint unique skills and assets that enhance your career prospects, making the transition smoother and more rewarding.

Leveraging Your Experience in Retirement by Consulting

Consulting is the bread and butter for many retirees looking to stay in the game. It’s like being the wise old owl that everyone comes to for advice, except you get paid for it. Understanding industry standards is essential for success in these consulting roles, as it ensures effective communication and credibility. I knew this guy, Frank, who spent 30 years in marketing. He thought his slogan-crafting days were over until a local startup practically begged him to help with their branding. Now he’s their go-to expert, working a few hours a week and loving every minute of it.

Entrepreneurship: Be Your Own Boss (Finally!) and Start a New Career

Then there’s entrepreneurship. It’s not just for the young’uns with their fancy apps and whatnot. Retirees are starting businesses left and right, often in fields they’ve always been passionate about but never had time to explore. My friend Sarah, a former teacher, opened a tutoring center that’s now the talk of the town. She gets to shape young minds without the hassle of standardized tests and parent-teacher conferences.

Tutoring and Mentoring: Passing the Torch

Tutoring and mentoring in retirement are great ways of leveraging your experience to pass on your knowledge and provide valuable insights. Whether it’s helping kids with math or showing a young professional the ropes of your industry, there’s always someone who wants to learn from your experience. And let’s be honest, there’s nothing quite like seeing that “aha!” moment on someone’s face when they finally get it.

Now, matching your skills to these opportunities is kinda like solving a puzzle. You’ve got all these pieces of experience and it’s about finding where they fit best. Maybe you were an accountant who secretly loves writing. Why not start a blog about personal finance for older people? Or perhaps you were in sales but have a knack for photography. Wedding photography could be your new gig – minus the stress of quotas and cold calls.

The key is to think outside the box. Your skills are probably more transferable than you realize. That attention to detail you developed as a quality control manager? That could make you an awesome proofreader or editor. The project management skills you honed over the years? Non-profits would kill for that kind of expertise on their boards.

But here’s the thing – and I can’t stress this enough – it’s all about balance. You didn’t work your tail off all those years just to jump right back into the rat race. The beauty of applying your experience in retirement is that you get to call the shots.

Finding Your Sweet Spot

It’s like Goldilocks – you want to find the engagement level that’s just right. Too little and you might feel antsy or unfulfilled. Too much and suddenly you’re wondering where your retirement went. The trick is to start small and adjust as you go.

Maybe you start with volunteering a few hours a week at a local organization. If that feels good, you might ramp up to some paid consulting work. Or if that feels like too much, scale back and try something less demanding. There’s a wide array of options available, so you can find what suits you best. There’s no one-size-fits-all approach here.

Remember, the goal is to stay active and engaged while still having time for all those retirement dreams. Whether it’s traveling, spending time with grandkids or finally mastering the art of sourdough bread (trust me, it’s trickier than it looks), your professional pursuits should enhance your retirement, not hijack it.

At the end of the day, applying your experience in retirement is about finding that sweet spot where you feel valued, stimulated and still have time to enjoy the fruits of your labor. It might take some trial and error, but hey, that’s half the fun. And who knows? You might just find your true calling at 65 or 70 or heck, even 80!

So go ahead, dip your toes back into the professional world. Just remember to keep one foot firmly planted in retirement paradise. After all, you’ve earned it!

Benefits of Leveraging Your Experience

Let’s talk about the perks of putting your hard-earned wisdom to work in retirement. Trust me, it’s not just about padding your wallet (though that’s a nice bonus). There’s a whole buffet of benefits waiting for you when you decide to dust off those skills and share ‘em with the world.

First up, let’s chat about personal fulfillment. You know that warm, fuzzy feeling you get when you nail a project or help someone out? Well, imagine that, but without the stress of performance reviews or office politics. It’s like the best parts of your career, distilled into pure satisfaction.

I remember talking to my old friend, Janet, who retired from teaching after 35 years. She thought she’d be happy with gardening and book clubs but something was missing. Then she started tutoring at-risk kids on weekends. The spark in her eyes when she talked about helping a struggling student finally get algebra? Priceless. It wasn’t about the paycheck; it was about making a difference and feeling useful.

And let’s not forget about purpose. It’s easy to feel a bit lost when you first retire, like you’re a ship without a rudder. But leveraging your experience? That’s like finding your North Star. It gives your days structure, your life meaning and hey, it gives you something to talk about at dinner parties besides your neighbor’s noisy dog.

Moreover, earning more money through side hustles, freelance work, or investing can be a significant advantage. Not only does it supplement your income, but it also helps you understand the implications of additional earnings on your Social Security benefits. Planning accordingly can ensure that you maximize your retirement payouts while staying financially secure.

Keeping Your Mind Sharp as a Tack

Now, let’s talk brain power. Using your professional skills in retirement is like CrossFit for your noggin. It keeps those mental gears well-oiled and running smoothly. You’re solving problems, learning new things and adapting to changes – all stuff that’s great for keeping the old gray matter in tip-top shape.

Retired individuals can keep their minds sharp through professional engagement. I have this friend, Tom, who was an IT whiz before he retired. He thought he’d be happy just messing around with his home computer setup. But after a few months he felt his tech skills getting rusty. So, he started helping local non-profits upgrade their systems. Not only did he sharpen his skills but he had to learn all sorts of new software. Said it made him feel like a kid again, staying up late to figure out a tricky coding problem.

And don’t even get me started on the social connections. When you’re working it’s easy to take for granted all those water cooler chats and lunch break laughs. But in retirement? Those casual interactions can be hard to come by. Staying professionally engaged, even part-time, keeps you connected to people. You’re meeting new folks, swapping stories and maybe even making some lifelong friends.

Retirement Talents and Connections Matter

It’s not just about avoiding loneliness (though that’s important too). It’s about staying connected to the world, keeping up with changes in your field and maybe even mentoring the next generation. There’s something pretty cool about being the wise old sage that younger folks turn to for advice.

Now I know what you’re thinking. “All this fulfillment and brain exercise sounds great but what about my golf game? And my plans to finally read War and Peace?” Don’t worry, I hear you. The beauty of leveraging your experience in retirement is that you get to set the terms. You can dip your toes in as much or as little as you want.

Show Me the Money (But Not Too Much)

And okay, let’s talk about the elephant in the room: money. Yeah, a little extra cash is nice, especially with the way prices keep going up these days. But here’s the thing – it doesn’t have to be about chasing big bucks. Think of it more like a little bonus that lets you splurge on that fancy dinner or spoil the grandkids a bit.

I know a guy, Bill, who was an accountant. In retirement he does taxes for a few clients each spring. Says it pays for his annual fishing trip with his buddies. It’s not about building a nest egg anymore; it’s about having a little mad money to play with.

The key is finding that sweet spot where you’re engaged enough to feel fulfilled but not so much that you’re stressed about deadlines or quotas. You’ve paid your dues, after all. Now it’s time to enjoy the fruits of your labor while still keeping those skills sharp.

Time for Networking

Connecting with potential employers can open up new opportunities to leverage your experience. Showcasing your transferable skills and building a professional digital presence on social media can attract attention from potential employers. Networking is also crucial in uncovering these opportunities, allowing you to stay active and engaged without the pressure of a full-time job.

So there you have it. Leveraging your experience in retirement isn’t just about staying busy or making a few extra bucks. It’s about feeling fulfilled, keeping your mind active, staying connected and yeah, maybe treating yourself to something nice now and then. It’s about creating a retirement that’s uniquely yours where you can share your wisdom, make a difference and still have time for all those retirement dreams.

Remember, you’ve spent decades building up this amazing toolbox of skills and knowledge. Why let it gather dust? There’s a whole world out there that could use what you know. And who knows? You might just find that the best chapter of your professional life is the one you write after retirement.

Getting Started

Alright, so you’re sold on the idea of using your experience in retirement. But where do you start? Don’t worry, I’ve got your back. Let’s break this down into manageable steps, ‘cause let’s face it, diving back into the professional world can feel a bit like jumping into a cold pool – it’s better to ease in than to cannonball.

First things first, let’s talk about assessing your skills and interests. This isn’t like those dreaded performance reviews from your working days. Nah, this is more like taking stock of your personal toolbox. What are you good at? What do you enjoy doing? Sometimes these two things overlap and sometimes they don’t – and that’s okay!

By leveraging your existing experience, you can enhance your appeal to prospective employers. I had a friend, Linda, who spent 30 years in corporate finance. She was a numbers whiz but what really got her excited was the company’s annual charity drive that she organized. In retirement she realized her true passion was event planning for non-profits. Who would’ve thunk it?

Digging Deep: Your Hidden Talents

Start by making a list. Include the obvious stuff – your job skills, the software you know, the industry knowledge you’ve accumulated. But don’t stop there. Think about the soft skills too. Are you great at mediating conflicts? Can you explain complex ideas in simple terms? These are gold nuggets that many employers and organizations would kill for.

And hey, don’t forget about your hobbies and personal interests. Maybe you’ve been an amateur photographer for years or you’re the go-to person in your family for tech support. These could be the seeds of your next adventure.

Once you have your list, it’s time to explore your options. This is the fun part! It’s like being a kid in a candy store, except instead of chocolate bars, you’re looking at potential new paths. Consider opportunities in the nonprofit sector, where your skills and interests can contribute to meaningful community service. Volunteering can open doors to potential paid positions within nonprofit organizations, allowing you to transition smoothly into this sector.

Exploring Your Options: A Buffet of Possibilities

Consulting is a popular choice for many retirees. It’s flexible, you can use your professional skills and you can often do it from home in your pajamas (no judgment here). But that’s just the tip of the iceberg.

Have you considered teaching or tutoring? Many community colleges and adult education programs are always looking for instructors with real world experience. Or maybe you could be a mentor to young professionals in your field. Trust me, they’re starving for the kind of wisdom you can share.

Volunteering is another option. It lets you give back to your community while using your skills. Plus it’s low pressure and a way to stay engaged. I know a retired HR manager who now helps at a local job training center. She says it’s the most rewarding work she’s ever done.

And let’s not forget about entrepreneurship. Maybe you’ve always had a business idea simmering in the back of your mind. Now’s the time to finally try it out. I’m not saying you need to be the next Jeff Bezos but a small side hustle can be a great way to stay active and earn some extra cash.

Resources: Your Roadmap to Success

Now, I know what you’re thinking. “This all sounds great but where do I actually find these opportunities?” Don’t worry, I gotcha covered.

First stop: the internet. (I know, I know, but bear with me.) Websites like RetiredBrains.com and CoGererate.org are treasure troves for retirees looking to stay engaged. They’ve got job listings, volunteer opportunities and tons of resources for people in your shoes.

Your local library is another great resource. Many offer workshops and classes on everything from starting a small business to brushing up on computer skills. And librarians are like the unsung heroes of information – they can point you towards resources you never even knew existed.

Don’t Sell Yourself Short

And don’t underestimate your own network either. Reach out to former colleagues, join professional groups on LinkedIn or attend industry events. You’d be surprised how many opportunities can come from just putting the word out there that you’re looking to stay active.

And here’s a tip: check out SCORE (Service Corps of Retired Executives). It’s a national organization that connects retired business pros with small businesses and entrepreneurs who need mentoring. It’s a great way to share your knowledge and maybe even learn a thing or two yourself.

Remember, this new chapter is all about baby steps. You don’t need to have it all figured out right away. Maybe start by volunteering a few hours a week or take on one small consulting project. See how it feels, adjust as needed and most importantly have fun with it!

The beauty of leveraging your experience in retirement is you get to write your own rules. There’s no one-size-fits-all here. It’s all about what works for you, what gets you out of bed in the morning (or at least out of bed before noon – hey, you’ve earned those lazy mornings!).

So go for it, take that first step. Dust off that resume, polish up those skills and see what’s out there. Who knows? Your next great adventure is just around the corner. And if you stumble a bit along the way? Well, that’s just part of the journey. After all, you’ve got a lifetime of experience to draw from. You’ve got this!

Conclusion:

Your professional experience is an asset to be used in retirement. Whether through consulting, starting a business or sharing your knowledge through tutoring, there are many ways to apply your expertise. As you explore these options remember leveraging your experience in retirement is about finding the balance between staying active and enjoying your free time.

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to us at no cost to you if you decide to purchase. This site is not intended to provide financial advice. You can read our affiliate disclosure in our privacy policy.