Small Business License PA: How to Get Yours in Pennsylvania (2024)

In the thriving landscape of Pennsylvania’s small businesses, obtaining a small business license PA is more than just a formality. It’s a necessity for operating legally and efficiently. With 99.6% of businesses in Pennsylvania being small businesses. Understanding the requirements and process of obtaining a small business license is crucial to your success. Are you ready to navigate the world of business licensing in Pennsylvania? Let’s dive in!

Short Summary

Understand Pennsylvania business license requirements and obtain necessary state-level Pennsylvania business licenses.

Research local licensing and permitting regulations to ensure your business’s legal operation and determine if there is a Pennsylvania business license cost.

Utilize professional services for a smooth licensing process, including understanding federal permits & renewals.

Understanding Pennsylvania Business License Requirements

Pennsylvania requires businesses to obtain a business license in Pennsylvania and any other permits prior to engaging in business activities. Such as obtaining a Pennsylvania sales tax license and professional licenses for specific service professionals and regulated industries. Different businesses require varying licenses. Additionally, certain professions or locations may necessitate extra licensing.

To facilitate your Pennsylvania business license application. You can use search tools, contact your local municipality, or engage a company like Incfile or MyCompanyWorks. Remember, you may need to obtain certain permits and licenses for activities such as signposting or recycling removal in Pennsylvania. Also, depending on the type of business and its location, you may need to acquire an occupational license.

State-Level Business Licenses

To start a business in Pennsylvania. A Pennsylvania business license is necessary for a business to address certain industries or professions. Additionally, fulfillment of the Pennsylvania Business Entity Registration Form is required.

Any Pennsylvania business that offers taxable items or services typically obtains a sales tax license. You must obtain this license, and you can do so by completing the PA-100 Enterprise Registration Form online.

The licensing approval process can take some time. It usually takes up to ten business days. Make sure to plan accordingly to avoid any delay in your business operations.

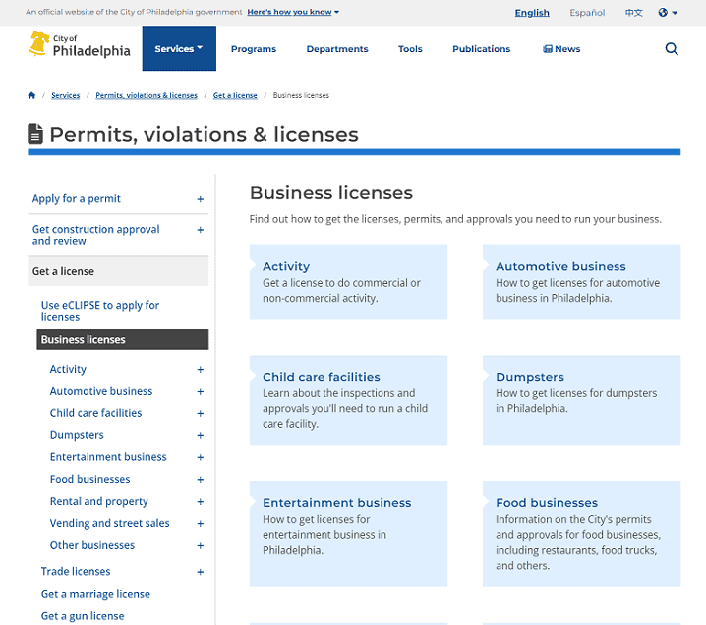

Local Licensing and Permitting

Local licensing requirements vary by municipality. So it’s essential to check with your local city government for the exact requirements for business permits. Each municipality in Pennsylvania may have different licensing requirements based on the nature of the business. For instance, a food truck or daycare might need an industry-specific municipal business license. You may need a zoning permit if you are purchasing or leasing real estate.

Understanding and complying with your local licensing requirements are crucial in running your business smoothly and legally.

Starting Your Small Business in PA: Key Steps

Starting a small business in Pennsylvania involves several key steps. Choosing the right business structure, registering with the Department of State, and obtaining a sales tax license. In addition to researching local licensing requirements, and considering federal business licenses and permits. With 99.6% of businesses in Pennsylvania being small businesses. It’s essential to follow the proper steps to ensure your business is set up for success.

Companies like ZenBusiness Inc. offer services to assist businesses with registering for Pennsylvania business licenses online. Which can be a valuable resource for new small business owners.

Choose the Right Business Structure

Selecting the appropriate business structure is crucial for your Pennsylvania business. The available structures include sole proprietorship, partnership, limited liability company (LLC), corporation, and S corporation. Each structure has its implications, such as tax responsibilities separate legal definitions, liability protection, and management structure.

For example, if you’re starting a barbershop in Pennsylvania. Forming a legal entity like a Pennsylvania Barber Shop LLC would be a fitting choice. You can even start a limited liability company online. Carefully consider the pros and cons of each business structure. Then consult with a professional if needed, to make the best decision for your specific business needs.

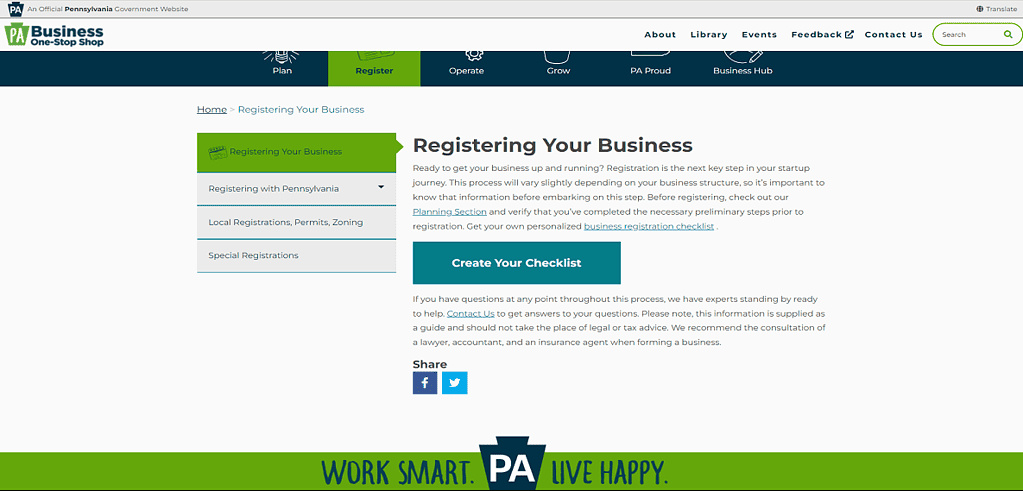

Register Your Business with the Pennsylvania Department of State

Once you’ve chosen your business structure, it’s time to register your business with the Pennsylvania Department of State. To do this, complete the necessary forms by using the PA-100 Enterprise Registration Form online. The process may differ slightly depending on the business structure.

If you’re operating under an assumed or fictitious name, the Department of State requires you to join its registry. The Department of State must meet certain publication requirements before registering a fictitious business name. These requirements are determined by the Department prior to assigning the name. Registering with the Department of State ensures your business’s legitimacy and compliance with Pennsylvania laws.

Obtaining a Sales Tax License in Pennsylvania

Obtaining a sales tax license in Pennsylvania is mandatory for businesses dealing with retail and services that collect sales tax. This license can be obtained without fees through the Pennsylvania Enterprise Registration Form or Form PA-100, which is available online.

By having a sales tax license, your business is authorized to collect sales tax from customers and submit it to the PA Department of Revenue. This not only keeps your business compliant with state regulations but also helps maintain a transparent relationship with your customers.

No registration fees are needed to obtain a Pennsylvania sales tax license. This is something to remember.

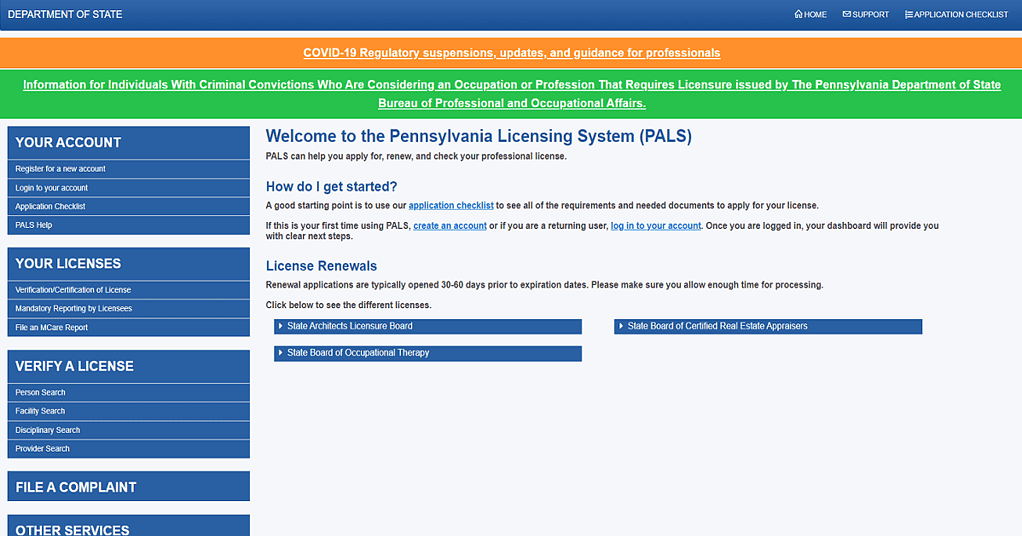

Navigating Professional Licensing in Pennsylvania

Professional licensing in Pennsylvania is crucial for specific service professionals and regulated industries. Proper licensing must be obtained before offering services in these fields. The Department of State’s website provides resources and contact information for the state’s regulatory boards. As well as other general inquiries regarding the state’s professional regulatory boards and licensing.

Professions such as medicine, law, engineering, teaching, nursing, and real estate sales necessitate state-specific professional business licenses in Pennsylvania. Ensuring you have the correct professional licensing in your field not only keeps your business compliant but also builds trust with your clients.

Researching Local Licensing Requirements

Researching local licensing requirements for a Pennsylvania business license involves checking your local government’s licensing requirements by visiting the city website or consulting local tax authorities. The PA Department of State can also provide guidance on local licensing requirements.

By understanding and complying with local licensing regulations, you can avoid potential fines and penalties. Therefore ensuring your business operates smoothly within your municipality. As a business owner, it’s your responsibility to stay informed about the local licensing requirements and make any necessary adjustments as your business grows and evolves.

Federal Licenses and Permits: Do You Need One?

Certain businesses operating in 11 regulated industries may require federal licenses and permits, such as alcohol manufacturing and sales. These businesses may also require state and local regulatory licenses and permits, depending on the nature of their operations. The combination of federal, state, and local business licenses and permits ensures your business operates legally and adheres to industry-specific regulations.

If you’re unsure whether your business requires a federal license, consult the Small Business Administration’s Licenses and Permits page. Which provides valuable resources and guidance on federal licensing requirements.

Keeping Up with License Renewals and Maintenance

Most Pennsylvania LLCs don’t need federal business licenses, but certain industries require them per the Small Business Administration Licenses and Permits page. Adhering to license renewals and maintenance is essential to abide by Pennsylvania’s business compliance regulations and to prevent penalties.

The Pennsylvania sales tax license, for example, must be renewed on a five-year cycle. The renewal process may vary from simple online renewals to more lengthy forms, depending on the nature of the license.

Staying organized and up-to-date with your license renewals will help your business remain in good standing with the state and maintain a positive reputation with your customers.

Tips for a Smooth Licensing Process

For a smooth licensing process, consider consulting with an attorney or Small Business Administration (SBA) consultant to ensure your business complies with all Commonwealth and local laws and regulations. Registering with the Department of Revenue is another crucial step, as they are responsible for registering most businesses and completing other associated licensing requirements.

Using resources like ZenBusiness Inc.’s Business License Report Service can help you identify the permits and other Pennsylvania business licenses required for your specific industry. Likewise staying informed and proactive in your licensing process will help you avoid potential roadblocks and set your business up for success.

Summary

In conclusion, obtaining a business license in Pennsylvania is a crucial step in starting and operating a successful business. By understanding state-level and local licensing requirements, choosing the right business structure, registering with the Pennsylvania Department of State, and staying informed about federal licenses and permits. Therefore you’ll ensure your business operates legally and efficiently. Armed with this knowledge, you’re now ready to embark on your journey to launch a thriving business in Pennsylvania.

Frequently Asked Questions

How much is a small business license in Pennsylvania?

In Pennsylvania, a small business license does not have a set cost. Businesses structured as partnerships, corporations, or sole proprietorships must pay licensing and application fees which generally total $125.

Additional fees may also be applicable.

Does Pa require a business license?

No, Pennsylvania does not require a state-issued business license for businesses to operate in the state.

However, it is important to check with local municipalities and counties as they may have licensing requirements for certain businesses.

Does a sole proprietor need a business license in pa?

Yes, a sole proprietor in Pennsylvania likely needs to get a business license. Especially depending on the specific type of business you are running, there may be additional permits or licenses that may be required.

It is best practice to check with local and state authorities for more information to make sure your general business license is compliant.

What is a business privilege license in pa?

A business privilege license in Pennsylvania is a requirement for any company that rents out commercial or residential property within the state. Additionally, the application process must be completed through the Berks Earned Income Tax Bureau, along with the applicable fees.

This ensures compliance with local laws and regulations and is a key factor in running a successful rental business.

Why do I need a business license in pa?

A business license is an essential requirement for anyone conducting business in the state of Pennsylvania. It ensures that your company complies with all relevant local, state, and federal regulations, as well as providing protection from liability and legal issues.

By obtaining a business license, you are taking an important step to ensure the success of your business operations.

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to us at no cost to you if you decide to purchase. This site is not intended to provide financial advice. You can read our affiliate disclosure in our privacy policy.