Starting a Business in Retirement: A Comprehensive Guide for 2024

Introduction:

Did you know that 25% of new entrepreneurs are between 55 and 64 years old? That’s right – retirement isn’t just about golf and gardening anymore! In 2024, more retirees than ever are taking the plunge into entrepreneurship. Whether you’re looking to supplement your income, pursue a lifelong passion, or simply stay active, starting a business after retirement can be an exciting and rewarding journey. But where do you begin? Exploring business ideas for retirees can be a great start. Consider online business ideas like consulting, home-based businesses, and franchises, which are popular choices for this demographic. Don’t worry – we’ve got you covered with this comprehensive guide to launching your post-retirement business venture. Let’s turn those golden years into your most prosperous ones yet!

Why Start a Retirement Business?

Alright, let me share my thoughts on starting a retirement business. It’s something I’ve been through myself, and boy, has it been a journey!

When I first retired, I thought I’d be spending my days traveling, maybe playing golf, and catching up on all those books I’d been meaning to read. Don’t get me wrong, I did plenty of that at first. But after a few months, I started feeling… well, kinda useless. That’s when the idea of starting my own business began to take root.

Now, I know what you’re thinking. “Start a business? At my age?” Trust me, I had the same doubts. But let me tell you, it’s been one of the best decisions I’ve ever made.

Benefits of Retiree Entrepreneurship

First off, let’s talk about the benefits of starting a business in retirement. For starters, it gives you a sense of purpose. After decades of working, suddenly having nothing to do can be a real shock to the system. Running your own business gives you a reason to get up in the morning, and let me tell you, that’s priceless.

But here’s the real kicker – we’ve got a secret weapon that young entrepreneurs don’t: experience. All those years in the workforce? They weren’t for nothing. I found myself drawing on skills I’d forgotten I even had. And my professional network? Gold mine. People I hadn’t talked to in years were suddenly invaluable resources and even became my first clients.

One great option in retirement is starting a consulting business. A consulting business allows you to leverage your previous skills and industry knowledge, providing valuable services to clients in various fields. Plus, it offers the flexibility to work at your own pace, creating a lucrative income stream during retirement.

Extra Income

Now, let’s get real for a second. Money matters, especially in retirement. Starting a new business can be a great way to supplement your retirement income. I’m not saying you’ll become the next Jeff Bezos, but even a little extra cash can make a big difference. It’s helped me take those vacations I always dreamed about without worrying about dipping into my savings.

But it’s not just about the money. Staying mentally sharp is crucial as we age, and running a business definitely keeps your brain firing on all cylinders. I’ve learned more about technology in the past few years than I did in my entire career! And socially? Let’s just say my calendar’s a lot fuller these days.

The best part, though? I’m finally pursuing a passion I never had time for when I was working full-time. I always loved the internet and and the thought of an online business, but never got beyond making just building a few websites. Now, I’m blogging and doing affiliate marketing online. It’s not making me rich, but the satisfaction of creating something with my own hands is worth more than any paycheck.

Frustrating Moments

Of course, it hasn’t all been smooth sailing. There’ve been plenty of frustrating moments when starting a business in retirement. Like when I accidentally deleted my entire website and had to start from scratch. Or the time I shipped a dining table to the wrong address and had to drive six hours to retrieve it. But you know what? Those mishaps make for great stories now.

If you’re considering starting small business, my advice is simple: go for it. Start small, be prepared for some hiccups along the way, and don’t be afraid to ask for help. Your years of experience are your biggest asset, so use them.

Remember, starting a business in retirement doesn’t have to mean the end of your productive years. It can be the beginning of an exciting new chapter. So why not take that hobby, skill, or wild idea you’ve always had and turn it into something more? You might surprise yourself with what you’re capable of. I know I did.

Assessing Your Readiness for Entrepreneurship

Alright, let’s dive into assessing your readiness for entrepreneurship. This is something I’ve been through myself, and boy, was it an eye-opener!

When I first toyed with a business idea and started my own business after decades in the corporate world, I thought I had it all figured out. Spoiler alert: I didn’t. But that’s okay! The journey of self-discovery is half the fun.

Let’s start with evaluating your skills, interests, and expertise. This might seem like a no-brainer, but trust me, it’s trickier than you’d think. I remember sitting down with a notepad, ready to jot down my skills, and… I froze. It’s funny how we can forget our own strengths sometimes. You might ask your friends and former colleagues what they think you’re good at. You might be surprised by what they say.

Personal Analysis

Now, onto conducting a personal SWOT analysis. If you’re not familiar with SWOT, it stands for Strengths, Weaknesses, Opportunities, and Threats. It’s a great tool for getting a bird’s-eye view of where you stand. When I did mine, I realized my biggest weakness was my tendency to procrastinate. Oops. But hey, recognizing the problem is the first step to fixing it, right?

One thing that retirees often overlook when starting a business in retirement is considering time commitments and lifestyle changes. Let me tell you, entrepreneurship is not for the faint of heart. It’s exhilarating, sure, but small businesses are a ton of work. I remember the first few months of my business, I was working more hours than I ever did in my 9-to-5.

But it’s not all doom and gloom. The flexibility is amazing. Need to take a Wednesday afternoon off for a trip to the beach? Go for it! Just be prepared to make up that time elsewhere.

Your Risk Tolerance

Now, let’s talk about assessing your risk tolerance and financial situation. This is where things get real. Starting a business in retirement always involves some level of risk, and you need to be honest with yourself about how much you’re willing to take on. Some retirement business ideas will fail. I had a friend who jumped into entrepreneurship without really thinking it through, and… well, let’s just say it didn’t end well.

For me, I took a good hard look at my savings, my retirement funds, and my monthly expenses. I made sure I had enough cushion to sustain myself for at least a year without income. It’s not glamorous, but it’s necessary. You don’t wanna be lying awake at night worrying about how you’re gonna pay the electric bill!

Lastly, let’s explore different retirement business ideas. This is where you can really get creative! There’s consulting, freelancing, online businesses, brick-and-mortar stores… the list goes on. I personally went the online route, leveraging my years of experience in sales management. But I’ve got friends who’ve started everything from dog-walking services to online craft stores.

Exploring Retiree Business Ideas

The key is to find a business idea that aligns with your skills, interests, and lifestyle goals. Don’t just chase the money – trust me, if you’re not passionate about what you’re doing, it’ll show. Consider various retirement business ideas that align with your skills, interests, and experiences to ensure fulfillment and financial stability in retirement.

One model that’s often overlooked is the “side hustle” approach. You don’t have to dive headfirst into full-time entrepreneurship. Many small business owners start with a part-time gig and see how it goes. That’s actually how I started – blogging and affiliate marketing on the side before retirement while still working. It gave me a chance to test the waters without taking on too much risk.

Readiness

At the end of the day, assessing your readiness for entrepreneurship is a deeply personal process. There’s no one-size-fits-all answer. But if you take the time to really evaluate your situation, be honest with yourself, and do your homework, you’ll be setting yourself up for success.

Remember, it’s never too late to start something new. Heck, Colonel Sanders was in his 60s when he started KFC! So don’t let age hold you back. If you’ve got the drive and the passion, go for it. Just make sure you’ve done your due diligence first. Trust me, your future self will thank you!

Identifying Your Retirement Business Ideas

Alright, let’s dive into identifying your business idea. I’ve been down this road a few times, and let me tell you, it’s a wild ride!

When I first started thinking about starting a business, I was all over the place. My mind was buzzing with ideas, but I couldn’t seem to focus on just one. That’s when I learned the power of brainstorming techniques. One day, I sat down with a giant whiteboard and just let my thoughts flow. I wrote down everything that came to mind, no matter how unusual it seemed. Here’s a tip, don’t judge your business ideas during this phase. You’d be surprised how a seemingly silly idea can turn into something brilliant later on.

Another technique that worked wonders for me was mind mapping. I’d start with a central concept and branch out from there. It’s like watching your thoughts grow into a tree of possibilities. Trust me, it’s way more fun than it sounds!

But here’s the thing – coming up with ideas is only half the battle. You gotta make sure your business aligns with your passions and expertise.

When Starting a Business in Retirement Explore Your Passions

So, I took a step back and really thought about what I loved doing. What could I talk about for hours without getting bored? What skills did I have that others might find valuable? It was like a lightbulb moment when I realized I could combine my love for writing with my experience in digital marketing. Suddenly, everything clicked.

Now, don’t get me wrong – passion alone isn’t enough. You’ve gotta keep your finger on the pulse of market trends and opportunities. I remember spending hours poring over industry reports and market forecasts. It felt like I was back in school, but this time, I was actually excited about the homework!

One thing that really helped was setting up Google Alerts for keywords related to my industry. It’s like having your own personal news feed of opportunities landing in your inbox every day. Trust me, it’s a game-changer.

Assessing Your Business Concept

But here’s where it gets tricky – evaluating the viability of your business concept. This is where you gotta be honest with yourself. Is there really a market for your idea? Can you make money from it? I’ve had my fair share of “brilliant” niche ideas that turned out to be duds when I looked at them objectively.

A little tip I picked up along the way: try to poke holes in your own idea. Play devil’s advocate. If you can’t find any major flaws, you might be onto something good.

Finally, don’t skimp on market research and competitor analysis. I know, I know, it’s not the most exciting part. But trust me, it’s crucial. I once launched a product without properly researching the competition, and boy, did I get a rude awakening. Turns out, there were already five other companies doing the exact same thing, but better. Talk about a facepalm moment!

Knowing Your Target Market

So, take the time to really understand your market. Who are your potential customers? What do they need? Who else is trying to meet those needs? And most importantly, how can you do it better?

Remember, identifying your business idea is just the first step to starting a business in retirement. It’s gonna be tough, and there will be times when you wanna throw in the towel. But stick with it, keep refining your idea, and who knows? You might just stumble upon the next big thing. And hey, even if you don’t, the lessons you learn along the way are priceless. Trust me on that one!

A well-structured business plan can help retirees generate extra income while pursuing their passions. This not only provides financial benefits but also allows them to engage in activities they love.

Creating a Solid Business Plan

Let me tell you, when I first decided to start my own business after retiring, I thought I could wing it. Big mistake! I learned the hard way that a solid business plan isn’t just some fancy document to impress investors – it’s your roadmap to success.

I remember sitting at my desk, surrounded by sticky notes and half-empty coffee cups, trying to figure out where to even begin. It was overwhelming, to say the least. But once I buckled down and started putting together a proper plan, things started falling into place.

First off, let’s talk about why a well-structured business plan is so dang important. It’s like building a house – you wouldn’t just start hammering boards together without a blueprint, right? The same goes for your business. A good plan helps you organize your thoughts, identify potential pitfalls, and gives you a clear direction to follow.

Crafting your Plan for Starting a Business in Retirement

Now, what should you include in your plan? Well, as a retiree entrepreneur, there are a few key components you don’t wanna forget:

Executive Summary: This is like the highlight reel of your entire plan. Keep it short and sweet, but make sure it packs a punch.

Company Description: What’s your business all about? What makes you unique? Don’t be afraid to let your personality shine through here.

Market Analysis: Who are your competitors? What’s the demand for your product or service? Trust me, you’ll want to know this stuff inside and out.

Organization and Management: How’s your business gonna be structured? Who’s in charge of what? Even if it’s just you for now, it’s good to think ahead.

Product or Service Line: What are you selling? Why is it awesome? Get specific here.

Marketing and Sales Strategy: How are you gonna get the word out? More on this in a bit.

Financial Projections: The numbers part. I know, I know – it’s not the most exciting, but it’s crucial.

Setting Goals for Your Retirement Business

Setting realistic goals and objectives is where a lot of folks trip up. I remember thinking I’d be rolling in dough within six months. Ha! Reality check: building a successful business takes time. Be ambitious, sure, but also be realistic. Set both short-term and long-term goals, and make sure they’re SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Now, let’s talk money. Developing financial projections and budgets can be a real headache, especially if you’re not a numbers person. But trust me, it’s worth the effort. Start by estimating your startup costs – everything from equipment to permits. Then, project your income and expenses for at least the first year, ideally three to five years out. Don’t forget to factor in your personal living expenses too!

Nothing Happens Overnight

Starting an online business can be a viable and flexible option for retirees looking to generate income. It allows you to utilize your skills and passions while offering the potential for financial success.

I learned this the hard way when I underestimated how long it’d take to turn a profit. Thank goodness for my retirement savings, or I might’ve been in hot water.

Lastly, let’s chat about marketing strategy. This is where you figure out how to get your amazing product or service in front of the right people. As a retiree, you might have a different target audience than younger entrepreneurs. Maybe you’re focusing on other retirees, or perhaps you’re tapping into a niche market based on your years of experience.

Whatever your angle, your marketing strategy should outline:

Who your ideal customer is (be specific!)

Where you can find them (online? Local community centers?)

How you’ll reach them (social media? Word of mouth? Local ads?)

What message will resonate with them

Don’t Spread Yourself Too Thin

Remember, you don’t need to be everywhere all at once. Start small, test different approaches, and see what works best for your business.

Creating a solid business plan takes time and effort, but it’s worth it. It’ll help you avoid costly mistakes, stay focused on your goals, and give you a much better shot at success. And hey, if you get stuck, don’t be afraid to ask for help. There are plenty of resources out there for us retiree entrepreneurs. Now go out there and make that business dream a reality!

Funding Your Retirement Business Venture

Alright, let’s dive into startup costs for your retirement business venture. Trust me, I’ve been down this road, and it’s not always smooth sailing. But hey, that’s part of the adventure, right?

When I first decided to start my own business after retiring from my teaching gig, I was pretty clueless about startup costs and where to get the money. I mean, I had my retirement savings, but the thought of risking it all made my stomach churn. Looking back, I’m glad I took the time to explore my options instead of just diving in headfirst.

Using Your Savings to Fund Retirement Business

First things first, let’s talk about using your retirement savings. It’s tempting, I know. You’ve got this chunk of change just sitting there, practically begging to be invested in your dream. But hold your horses! You’ve gotta be smart about this. I made the mistake of pulling out a big chunk of my 401(k) without really understanding the tax implications. Boy, was that a wake-up call come tax season.

Here’s what I learned: if you’re gonna use your retirement funds, consider a Rollover for Business Startups (ROBS). It lets you use your retirement money as startup costs without those pesky early withdrawal penalties. But seriously, talk to a financial advisor before you do anything. I wish I had.

Now, onto small business loans and grants. This is where things get interesting. You can find many options on the internet where you can fill out applications. It can feel like a full-time job! But you know what? It can pay off. You might even snag a small business loan from a local credit union. They are sometimes way more willing to work with you than the big box banks.

Government Grants

And don’t forget about grants! There’s money out there specifically for us older entrepreneurs. The AARP Foundation has some great resources. The grants they offer are not usually a huge amount, but every little bit helps, right?

Crowdfunding is another avenue you can explored. You set up a campaign on Kickstarter for your business. It can be nerve-wracking putting yourself out there like that, but the sometimes, the support received can be overwhelming. Not only can you raise some capital, but you may also attract your first customers! Talk about killing two birds with one stone.

Peer-to-peer lending is another option worth looking into. Platforms like Prosper and LendingClub connect borrowers with individual lenders. The interest rates can be lower than traditional loans, which is a plus. I didn’t end up going this route, but I know a fellow retiree who did and it worked out well for him.

Other Options for Funding a Retirement Business

Now, let’s talk about angel investors and venture capital. These can be great options if you’re planning something big or tech-related. I’ll be honest, I didn’t pursue this route either, because my business didn’t really fit the bill. But if you’ve got a scalable idea with high growth potential, it’s definitely worth considering.

One thing I learned through this whole process is the importance of having a solid business plan. No matter where you’re seeking funding from, they’re gonna want to see that you’ve thought things through.

Nothing Good is Ever Easy

Look, starting a business isn’t easy. There were days when I questioned whether I was mistaken for even trying. But let me tell you, the feeling of building something of your own, of turning your passion into a business, it’s worth all the headaches and sleepless nights. Being your own boss offers retirees the freedom and flexibility to manage their schedules and client relationships, making it an ideal choice for those seeking independence.

So, if you’re sitting there wondering whether to take the plunge, I say go for it. Just be smart about it, do your research, and don’t be afraid to ask for help. We may be retired, but we’ve still got plenty to offer the world. Now get out there and make it happen!

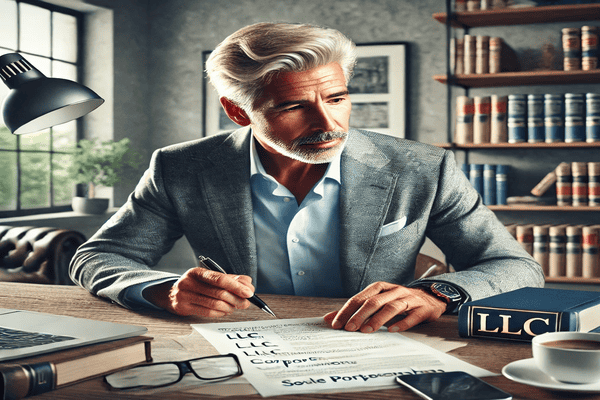

Legal Considerations and Business Structure

Let me tell you, when I first decided to start a business in retirement, I had no clue about all the legal stuff I’d need to deal with. Talk about a headache! But looking back, I’m glad I took the time to figure it all out. It’s kinda like building a house – you need a solid foundation, or the whole thing might come crashing down.

So, first things first: choosing a business structure. I remember sitting at my desk, scratching my head over whether to go with a sole proprietorship or an LLC. I mean, who even knows what those mean when you’re just starting out? After some research (and a lot of coffee), I decided on an LLC for my little venture. Why? Well, it offered some nice protection for my personal assets, which was crucial since I didn’t want to risk my retirement savings if things went south.

Taking Your Time When Registering

But here’s the kicker – registering the business and getting all the necessary licenses was a whole other ball game. I swear, I felt like I was back in school, filling out form after form. Be sure and double-check everything before you submit! I made a reckless mistake on one form and had to start all over. Talk about frustrating!

Now, let’s chat about taxes for a second. As a retiree, I thought I had this tax thing figured out. Boy, was I wrong! Turns out, running a business adds a whole new layer of complexity to your tax situation. I learned the hard way that it’s super important to understand how your business income might affect things like Social Security benefits or Medicare premiums. Trust me, you don’t want any surprises come tax season.

One thing I can’t stress enough is protecting your personal assets and retirement savings. When you’ve worked hard all your life to build up that nest egg, the last thing you want is to put it at risk. That’s why I’m glad I chose an LLC structure – it provides a nice barrier between your personal and business finances. But don’t just take my word for it – make sure you understand exactly how your chosen business structure protects you.

Now, I’m no expert in all this legal and financial mumbo-jumbo. That’s why I eventually broke down and consulted with some professionals. Yeah, it cost a bit upfront, but let me tell you, it was worth every penny. A good lawyer and accountant can help you navigate all these tricky waters and potentially save you from making costly mistakes down the road.

Structure Is Important

Looking back, I wish I’d known just how important all these legal considerations were from the get-go. It would’ve saved me a lot of stress and sleepless nights. But hey, live and learn, right? If you’re thinking about starting a business, do yourself a favor and take the time to get all your ducks in a row legally. It might seem like a pain now, but trust me, you’ll thank yourself later.

Oh, and one more thing – don’t be afraid to ask for help! There are tons of resources about retirement business ideas for retirees starting businesses. Local small business associations, online forums, even your local library might have some great info. And remember, it’s okay to start small and grow as you learn. Rome wasn’t built in a day, and neither is a successful retirement business.

So there you have it – my two cents on the legal side of starting a business. It ain’t always easy, but with the right preparation and mindset, it can be an incredibly rewarding experience. Just make sure you’ve got all your legal bases covered before you dive in headfirst. Trust me, your future self will thank you!

Leveraging Technology for Your Business

When I first started my little side hustle, I was fairly tech-savvy and it helped! But, if you’re not and want to keep up in today’s world, you need to get with the program – literally!

So, let’s chat about some essential tech tools that have been total game-changers for me. First up, project management software. I used to keep track of things on Post-it notes everywhere. Then a friend introduced me to Trello, and suddenly I could breathe again. It’s like having a virtual assistant that never sleeps (and doesn’t drink all my coffee).

Now, let’s talk about building an online presence. It’s not as difficult as you might think. I recommend using Wix to set up a simple site. Wix makes it very easy to do and you want people from everywhere to find your work. Very important, make sure your site looks good on mobile. I learned that the hard way when my someone pointed out that my beautiful desktop site looked like a jumbled mess on a phone.

Social media was another hurdle I had to overcome. Instagram can become your best friend once you figure out how to take decent photos of what you’re selling (hint: natural light is your BFF). It’s not just about posting pretty pictures, though. Engaging with your followers is key. Try to respond to every comment, even if it’s just a quick “Thanks!” It’s all about building relationships.

The Online World

When it comes to actually selling stuff online, you can get lost at sea. There are so many e-commerce platforms out there, it’s enough to make your head spin. Use some trial and error. One good one is Shopify. It’s user-friendly enough for any technophobe, but powerful enough to handle everything you need. Plus, it integrates seamlessly with accounting software, which saves hours of headaches come tax time.

Speaking of accounting, can we talk about how amazing QuickBooks is? I used to dread doing my books, but now it’s almost… fun? Okay, maybe fun is stretching it, but it’s definitely less painful. And being able to see at a glance how my business is doing financially? Priceless.

Now, digital marketing. Oof, that was a steep learning curve. I started with some basic Google Ads, targeting people searching for what I was selling. It was hit or miss at first, but as I learned to refine my keywords and ad copy, I saw a real uptick in sales. Email marketing has been another winner for me. I use Mailchimp to send out monthly newsletters showcasing new pieces and sharing behind-the-scenes peeks at my process. My subscribers seem to really dig it.

Simplify Your Retirement Business With Automation

One area where I’m still learning is automation. A good tools that works like magic is Zapier which connects to different apps. For example, when someone buys a piece from your Shopify store, it automatically adds them to your Mailchimp list and creates a to-do in Trello for you to start working on their order. It’s not perfect – sometimes things slip through the cracks – but it’s a heck of a lot better than trying to remember to do all that manually.

Look, I’m not gonna pretend I’ve got it all figured out. Technology is always changing, and there’s always something new to learn. But embracing many of these tools has allowed me to focus more on what I love – creating content – and less on the nitty-gritty of running a business. Selecting the right retiree business ideas can also help maintain a healthy work-life balance, ensuring that your entrepreneurial ventures fit seamlessly into your retirement lifestyle. So if this old dog can learn these new tricks, I bet you can too. Just take it one step at a time, and don’t be afraid to ask for help when you need it. Trust me, your future self will thank you!

Balancing Business and Retirement Lifestyle

Let me tell you, starting a business in retirement isn’t exactly a walk in the park. When I first decided to turn my hobby into a small business, I thought I’d have all the time in the world. Boy, was I wrong! I had to learn to manage my time better, or I’d risk my retirement turning into just another job.

So, I started setting strict work hours for myself. It wasn’t easy at first – I’d get caught up in a project and suddenly it’d be 9 PM. But I stuck with it, and now I’ve got a pretty good system going. I work from 9 to 3, Monday through Thursday. It’s enough time to keep the business running smoothly, but it also leaves plenty of room for golf and grandkid time.

if you have family willing to help, involving them in the business can be a game-changer. Children can help with the online stuff – apparently, you need more than just a Facebook page these days. Who knew? It’s great bonding time, and they can learn some valuable skills. Plus, it gives you an extra set of hands without having to hire anyone.

Take Time To Relax

But let me tell you, maintaining that work-life balance as a retiree entrepreneur? It’s tricky. There are days when I feel like I’m back in my 30s, burning the candle at both ends. That’s when I have to remind myself why I started this business in the first place – for enjoyment, not stress.

So instead, I’ve focused on refining my skills and taking on higher-value projects. It’s allowed me to grow my income without growing the size of the business. And as for exit strategies? Well, I’m hoping to keep this going as long as my hands and eyes hold out. After that, who knows?

One thing I wish I’d thought about earlier was how to adapt the business as I get older. I’m in good health now, knock on wood, but I know that might not always be the case. I’ve started making some changes – got myself an ergonomic chair for the workshop, invested in some power tools to reduce the physical strain, that sort of thing.

Look, balancing a business with retirement isn’t always easy. There are days when I wonder if I made the right choice. But then I look at the beautiful pieces I’ve created, the connections I’ve made in the community, and the sense of purpose it gives me – and I know it’s worth it. Just remember, it’s your retirement. Make sure your business is working for you, not the other way around.

Networking and Building Support Systems

When I first jumped into retirement entrepreneurship, I felt totally out of my element. After years of working for others, suddenly I was flying solo, trying to turn my passion into a business. Talk about a wake-up call!

I remember sitting in my home office, staring at the computer, thinking, “What am I doing?” It was overwhelming. But I quickly learned that going it alone is a recipe for burnout.

So, I started connecting with other retiree entrepreneurs. Joining these communities was a game-changer. It’s like finding your league – people who get what you’re going through and are happy to share their experiences.

I joined several online forums of retirement entrepreneurs, and the knowledge there was incredible. From taxes (ugh) to marketing ideas, these folks had seen it all. But it wasn’t just about advice – it was about support. When I was ready to quit, their encouragement kept me going.

Live Events

Industry events were next on my list. I’ll be honest, the thought of attending any of them made me nervous. But I pushed myself to go to a particular gardening expo, and I’m glad I did! I learned about some new trends and met some amazing people. One guy, Bob, had turned his hobby into a thriving nursery business. He’s been an invaluable mentor ever since.

Speaking of mentors, if you don’t have one, get on it! Having a business coach is like having a GPS for your entrepreneurial journey. They’ve been where you want to go and can help you avoid the potholes.

There are many online communities. Joining forums and social media groups have been incredibly helpful for me. Whether I’m troubleshooting a problem or looking for recommendations, there’s always someone ready to help.

So, my advice? Don’t try to go it alone. Reach out, connect with other small business owners, and build your support system. It’ll make your entrepreneurial journey not just easier, but a whole lot more fun too. And isn’t that what retirement’s all about?

Overcoming Challenges Unique to Retiree Entrepreneurs

Let me tell you, starting a business after retirement isn’t all sunshine and rainbows. I’ve been there, done that, and boy, did I learn some lessons along the way. When I first decided to launch my online blogging and affiliate marketing gig, I thought it would be a breeze. I mean, I had decades of experience under my belt – how hard could it be? Turns out, pretty darn hard.

First off, let’s talk about those pesky age stereotypes. I remember walking into a networking event, feeling pretty confident with my snazzy new business cards. But as soon as I opened my mouth to introduce myself, I could see the skepticism in people’s eyes. It was like they were thinking, “shouldn’t you be playing shuffleboard somewhere?” That stung, I won’t lie. But you know what? I used it as fuel. I started dropping casual references to TikTok and blockchain in conversations, just to see their jaws drop. Take that, whippersnappers!

Technology Is Important For Your Retirement Business

Now, staying current with technology – that’s been a whole other ballgame. I thought I was pretty tech-savvy because I could use Facebook to stalk my family. Ha! The first time someone asked me about my SEO strategy, I thought they were talking about a new type of vitamin supplement. I’ve had to put in some serious hours learning the ropes. YouTube tutorials have become my best friend.

And let’s not forget about the physical stuff. Some days, my arthritis acts up so bad I can barely type. But you adapt, you know? I’ve got this fancy ergonomic keyboard now, and I’m not ashamed to say I use voice-to-text more often than not. It’s not perfect – sometimes it types “ducks” instead of… well, you know. But hey, it gets the job done.

The business landscape changes faster than I can keep up with some days. Just when I think I’ve got a handle on things, some new platform or strategy pops up. It can be overwhelming, not gonna lie. But I’ve learned to focus on what I’m good at and outsource the rest. Sure, I might not be able to code a website from scratch, but I can hire someone who can.

One thing that’s really helped me is finding a community of other retiree entrepreneurs. We meet up once a month for coffee and commiseration. It’s nice to know I’m not the only one struggling to read the tiny print on my smartphone or trying to figure out what the heck a “meme” is supposed to be.

Despite all the challenges, I wouldn’t trade this experience for anything. Starting a business in retirement has kept my mind sharp and given me a whole new lease on life. Sure, I might move a little slower and need more naps than I used to, but I’ve got wisdom and experience that money can’t buy. And let me tell you, there’s nothing quite like the feeling of making a big sale or seeing your business grow, no matter what age you are.

So if you’re thinking about becoming an entrepreneur in your golden years, I say go for it. Just be prepared for a wild ride – and maybe invest in some good reading glasses. Trust me, you’re gonna need them.

Conclusion:

Starting a business after retirement can be exciting! It can give you a sense of purpose, happiness, and extra money. This guide helps you turn your business dreams into reality in 2024 and beyond.

Remember, your years of experience are your biggest strength. Use them wisely! You could start a consulting firm, open a small bookshop, or launch a new tech company. The business world is ready for what you have to offer.

So why wait? It’s time to change what retirement means. You can start a new, exciting part of your life as a business owner. Your best years might be just around the corner!

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to us at no cost to you if you decide to purchase. This site is not intended to provide financial advice. You can read our affiliate disclosure in our privacy policy.